Get the free wisconsin wt 7 tax form 2011 - revenue wi

Show details

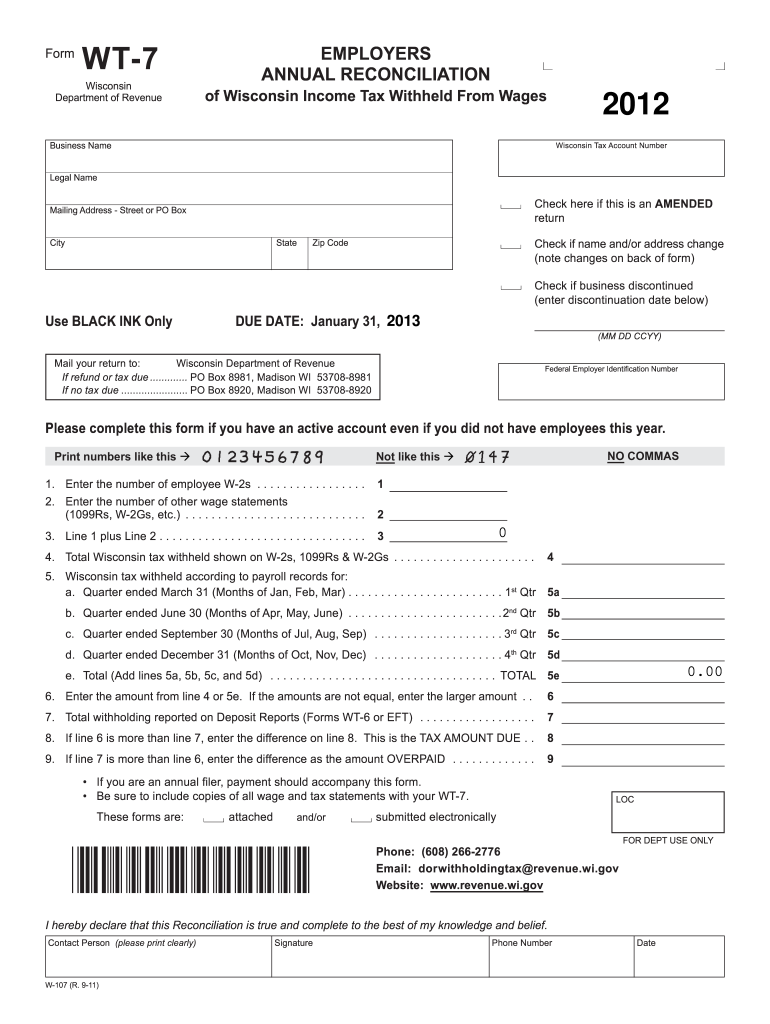

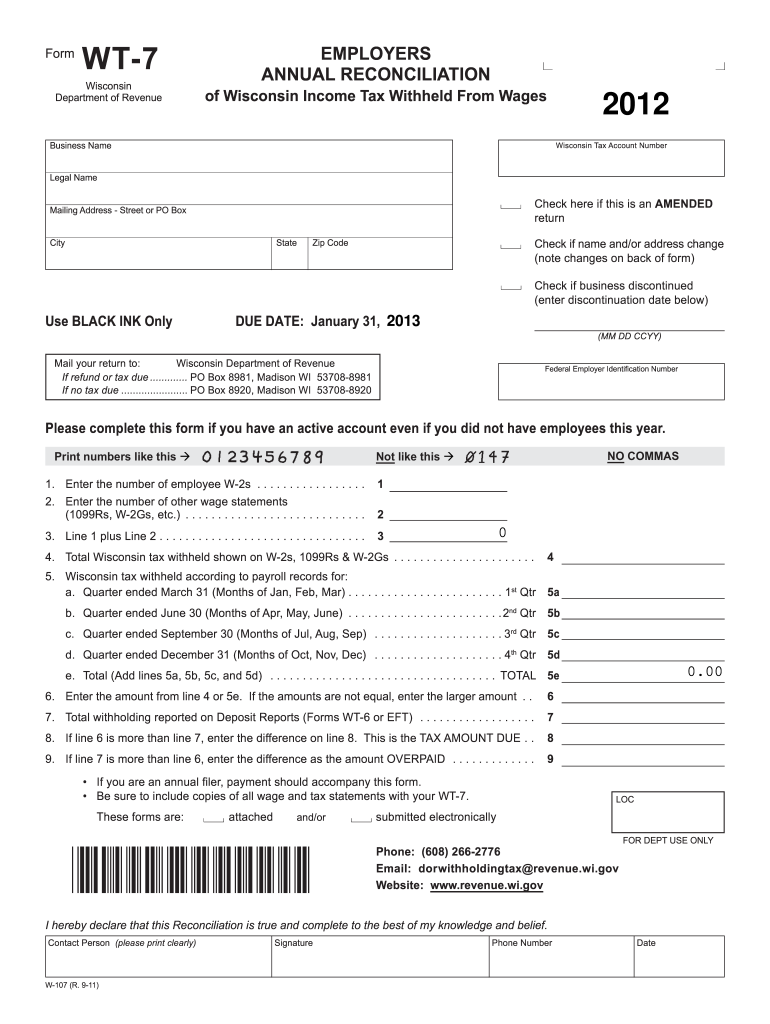

Save To Page 2 Form WT-7 Print Clear EMPLOYERS ANNUAL RECONCILIATION Wisconsin Department of Revenue of Wisconsin Income Tax Withheld From Wages 2012

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign wisconsin wt 7 tax

Edit your wisconsin wt 7 tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your wisconsin wt 7 tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing wisconsin wt 7 tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit wisconsin wt 7 tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out wisconsin wt 7 tax

How to fill out WI DoR WT-7

01

Download the WI DoR WT-7 form from the official website.

02

Provide your full name and address in the appropriate sections.

03

Indicate your filing status by checking the correct box.

04

Enter your social security number or taxpayer ID number.

05

Report your income information as requested on the form.

06

Complete any additional sections regarding credits or deductions.

07

Review the form for accuracy and completeness.

08

Sign and date the form in the designated areas.

09

Submit the form according to the instructions provided (e.g., mail, online, etc.).

Who needs WI DoR WT-7?

01

Individuals or businesses who need to report withholding information to the Wisconsin Department of Revenue.

02

Taxpayers who have received income subject to Wisconsin withholding.

03

Employers who are required to report wages and tax withholding for employees.

Fill

form

: Try Risk Free

People Also Ask about

Does Wisconsin charge tax on pensions?

If you are a full-year resident of Wisconsin, generally the same amount of your pension and annuity income that is taxable for federal tax purposes is taxable by Wisconsin. If you are a nonresident of Wisconsin, your pension and annuity income is generally nontaxable by Wisconsin.

What is Wisconsin tax form WT 7?

It is a secure process developed by the Department of Revenue (DOR) for employers and/or their representatives to transmit their Employers Annual Reconciliation of Wisconsin Income Tax Withheld from Wages (Form WT-7) data to DOR via an electronic file over the Internet.

Does Wisconsin tax out of state income?

Nonresidents - Wisconsin taxes only your income from Wisconsin sources. Part-year residents - During the time you are a Wisconsin resident, Wisconsin taxes your income from all sources. During the time you are not a resident of Wisconsin, Wisconsin only taxes your income from Wisconsin sources.

Does Wisconsin tax out of state pensions?

WISCONSIN TREATMENT GENERALLY SAME AS FEDERAL The amount of your retirement benefits that are taxable for federal income tax purposes are also taxable for Wisconsin. This is true even though the retirement benefit may be due to services performed in another state.

At what age do seniors stop paying property taxes in Wisconsin?

At least one owner of the property must be at least 65 years of age.

What is Wisconsin state tax on 401k withdrawal?

Withdrawals from retirement accounts are fully taxed. Wages are taxed at normal rates, and your marginal state tax rate is 4.65%. Public pension income is not taxed, and private pension income is fully taxed.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my wisconsin wt 7 tax in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your wisconsin wt 7 tax and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I edit wisconsin wt 7 tax on an iOS device?

You certainly can. You can quickly edit, distribute, and sign wisconsin wt 7 tax on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How do I fill out wisconsin wt 7 tax on an Android device?

Use the pdfFiller Android app to finish your wisconsin wt 7 tax and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

What is WI DoR WT-7?

WI DoR WT-7 is a form used in Wisconsin for businesses to report withholding taxes on payments made to non-residents or certain entities.

Who is required to file WI DoR WT-7?

Any business or entity in Wisconsin that makes payments to non-resident individuals or certain entities that require withholding should file the WI DoR WT-7.

How to fill out WI DoR WT-7?

To fill out WI DoR WT-7, you need to provide details such as the payer's information, recipient's information, amounts withheld, and the nature of the payments. It's important to follow the guidelines specified by the Wisconsin Department of Revenue.

What is the purpose of WI DoR WT-7?

The purpose of WI DoR WT-7 is to report and remit withholding taxes to the state of Wisconsin, ensuring compliance with tax regulations regarding payments to non-residents.

What information must be reported on WI DoR WT-7?

The information that must be reported includes the name and address of the payer and recipient, the amounts paid, the total amount withheld, and the type of payment being reported.

Fill out your wisconsin wt 7 tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wisconsin Wt 7 Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.